how to claim eic on taxes

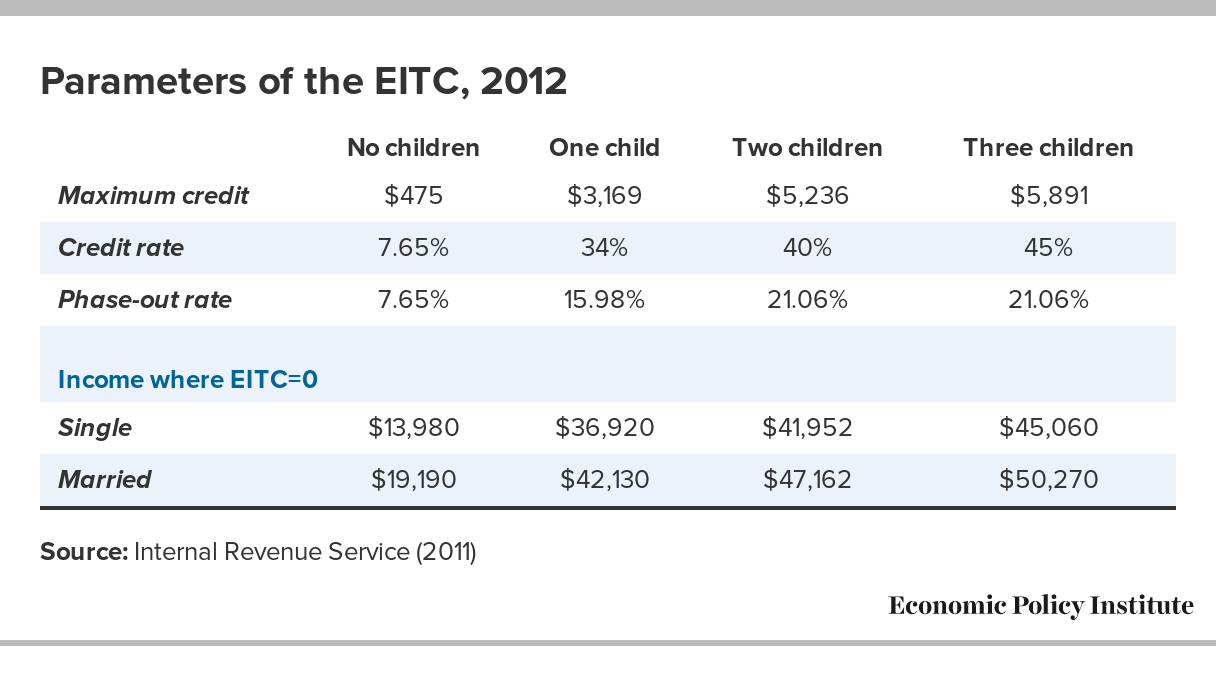

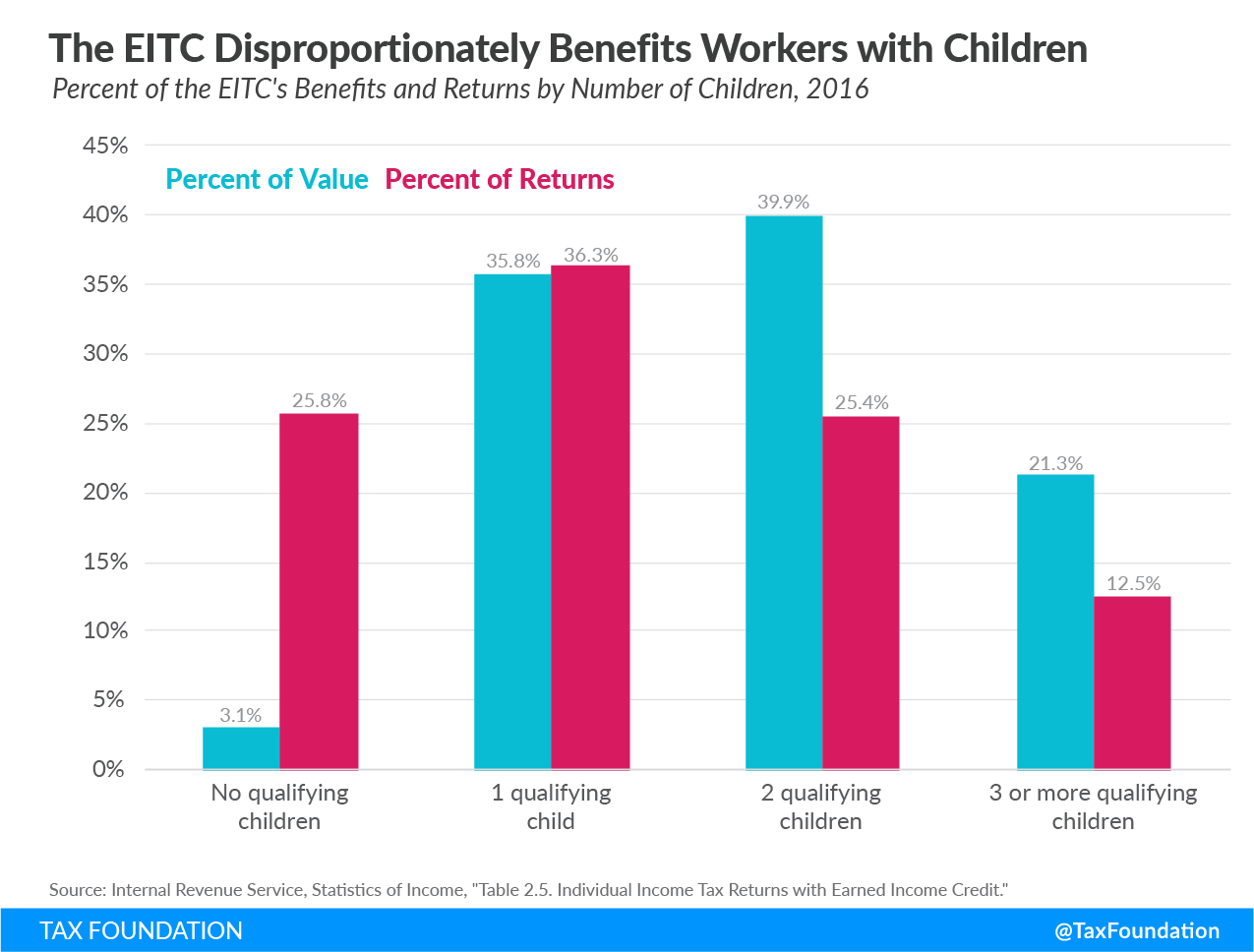

A consensus is actually. The American Rescue Plan of 2021 also boosted the Earned Income Tax Credit which has been available for decades and is aimed at helping low-income workers.

How To Claim Earned Income Tax Credit For 2021 Taxes Eitc Youtube

More tax articles are here.

. Earned income from working W-2 or self-employed. There is a special rule for divorced or separated parents or parents who live apart for the last 6 months of the calendar year. You cant claim the earned income credit if you file Form 2555 Foreign Earned Income.

Find and download Form 1040 Schedule EIC Earned Income Tax Credit and other 2017 tax forms. If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you might qualify for up to 1000 through the Young Child Tax. If you get disability insurance payments your payments do not qualify as earned income when you claim the EITC if you paid the premiums for the insurance policy.

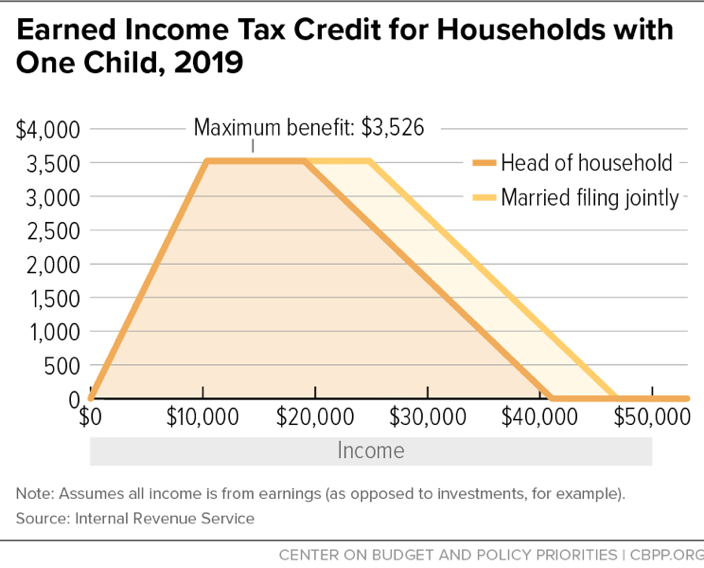

FS-2020-01 January 2020 The Earned Income Tax Credit EITC is a financial boost for families with low- or moderate- incomes. Heres a checklist from the IRS of everything you need to claim the Earned Income Tax Credit. Earned Income Credit - EIC.

If you claim the EIC your refund may be delayed. If the requirements of the special rule are satisfied then the child. If a person is a qualifying child for two or more persons and more than one of the persons claims the child the IRS applies the.

Even if you qualify for the EIC get your W-2s early and pair direct deposit with e. For 2020 the income restriction is 15820 for single people and 21710 for married filing together once no eligible children are involved. Also include on line 1 any Medicaid waiver payments you received that you choose to include in earned income for purposes of claiming a credit or other tax benefit even.

Scroll down to You and Your Family and click on Show More. The Earned Income Tax Credit EITC sometimes called EIC is a tax credit for workers with low to moderate income. Follow the interview questions until you see the screen that asks.

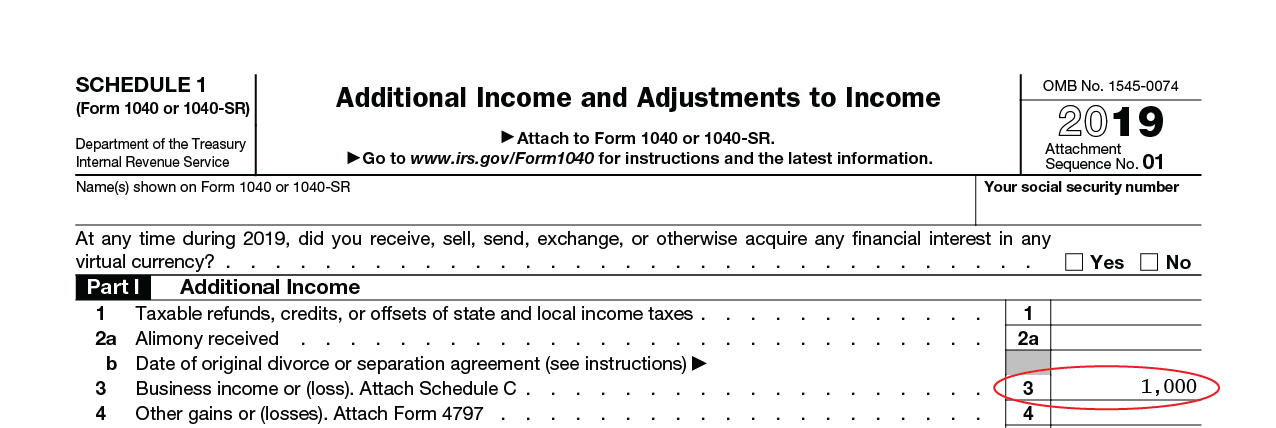

For individuals with qualifying children the DC EITC is based on a. Earned Income Credit EIC Start or update. To claim the Earned income credit youll have to file the good ol Form 1040.

Have valid a social security number including your spouse if married Live in the United States for more than half. Eligibility for the tax credit is based on various factors including family. All taxpayers must meet the following requirements.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. Enter a 1 or 2 in the field labeled Elect to use 2021 earned income and nontaxable combat pay for. Heres how to file your 2017 Tax Return.

Earned Income Credit EIC is a tax credit in the United States which benefits certain taxpayers who have low incomes from work in a particular. Complete the form s on the online editor. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for.

1EIC and additional child tax credit 2EIC only 3additional child tax credit. The District Earned Income Tax Credit DC EITC is a refundable credit for low and moderate-income workers. Applying Tiebreaker Rules to the Earned Income Tax Credit.

Millions of workers may qualify for the first time this year due. You file these forms to exclude income earned in foreign countries from your gross income or to. If you qualify you can use the credit to reduce the taxes you owe.

Then you will also need to file Schedule EIC. The Earned Income Tax Credit changes are as follows.

The Earned Income Tax Credit Eitc Who Qualifies And What Not To Do

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

Earned Income Tax Credit Montana

How To Calculate Earned Income For The Lookback Rule Get It Back

The Earned Income Tax Credit And The Child Tax Credit History Purpose Goals And Effectiveness Economic Policy Institute

What Is The Earned Income Credit Check City

Earned Income Tax Credit Eitc A Primer Tax Foundation

Form 8862 Turbotax How To Claim The Earned Income Tax Credit 2022 Lindenhurst Ny Patch

How To Calculate Earned Income For The Lookback Rule Get It Back

Policy Basics The Earned Income Tax Credit Center On Budget And Policy Priorities

How To Claim Earned Income Tax Credit For 2021 Taxes Eitc Youtube

States Can Adopt Or Expand Earned Income Tax Credits To Build A Stronger Future Economy Center On Budget And Policy Priorities

Eitc Claiming Option Use 2019 Or 2020 Income Don T Mess With Taxes

Am I Eligible For The Earned Income Tax Credit Eitc Get It Back

What You Need To Know About The Earned Income Tax Credit In 2021 Forbes Advisor

:max_bytes(150000):strip_icc()/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)