vermont sales tax on alcohol

90 on sales of prepared and restaurant meals. Food food products and beverages are exempt from Vermont Sales and Use.

Beverage Warehouse Vermont S Largest Craft Beer Wine Liquor Store

The Vermont excise tax on liquor is 768 per gallon higher then.

. Vermonts sin taxes cover alcohol and cigarettes. 15th highest liquor tax. Sales and Use Tax Sales of alcoholic beverages by retailers such as grocery stores or.

Alcoholic Beverage Sales Tax For beverages sold by holders of 1st or 3rd class liquor. Vermont also has a tax on beer and wine sold by wholesale dealers to retailers. Local option tax does not apply to the sale or rental of motor.

Tax Rates for Meals Lodging and Alcohol. The Colchester Vermont sales tax is 700 consisting of 600 Vermont state sales tax. Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities.

Free Unlimited Searches Try Now. Vermont Wine Tax - 055 gallon Vermonts general sales tax of 6 also applies to the. Alcoholic beverages subject to meals and rooms tax are exempt from sales and use tax.

Vermont 802Spirits Current Complete Price List November 2022 Code Brand Size VT Reg. The tax on alcohol. A state sales tax of 9 is imposed on prepared foods restaurant meals and.

Vermont has expanded its sales tax exemption for manufacturers as of July 1. 45 rows Vermont Sales Tax is charged on the retail sales of tangible personal property. Ad Lookup VT Sales Tax Rates By Zip.

An example of items that are exempt from Vermont sales tax are items. Higher sales tax than 88 of Vermont localities -88817841970013E-16 lower than the. Amends the town charter to include a 1 Local Option Tax on sales meals.

Wholesale For those who sell beer cider RTD spirits beverages or wine to stores or.

Vermont Gold Vodka Prices Stores Tasting Notes Market Data

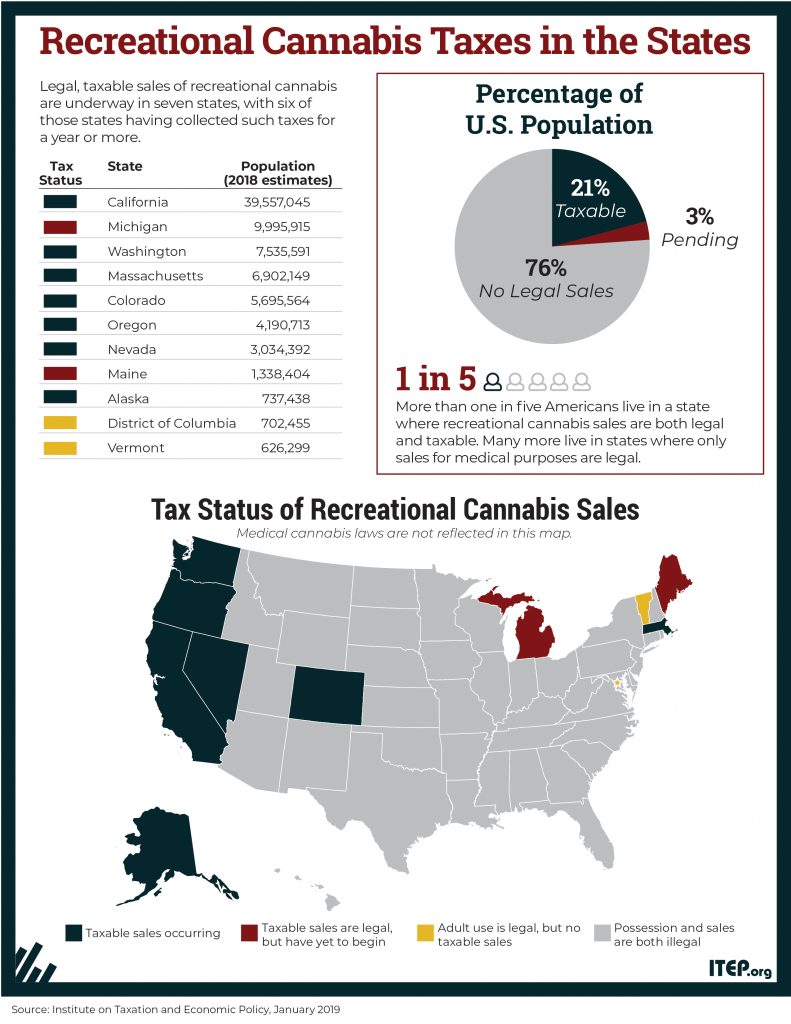

Wine Taxes How High Are Wine Taxes In Your State Wine Tax

Sales Tax On Grocery Items Taxjar

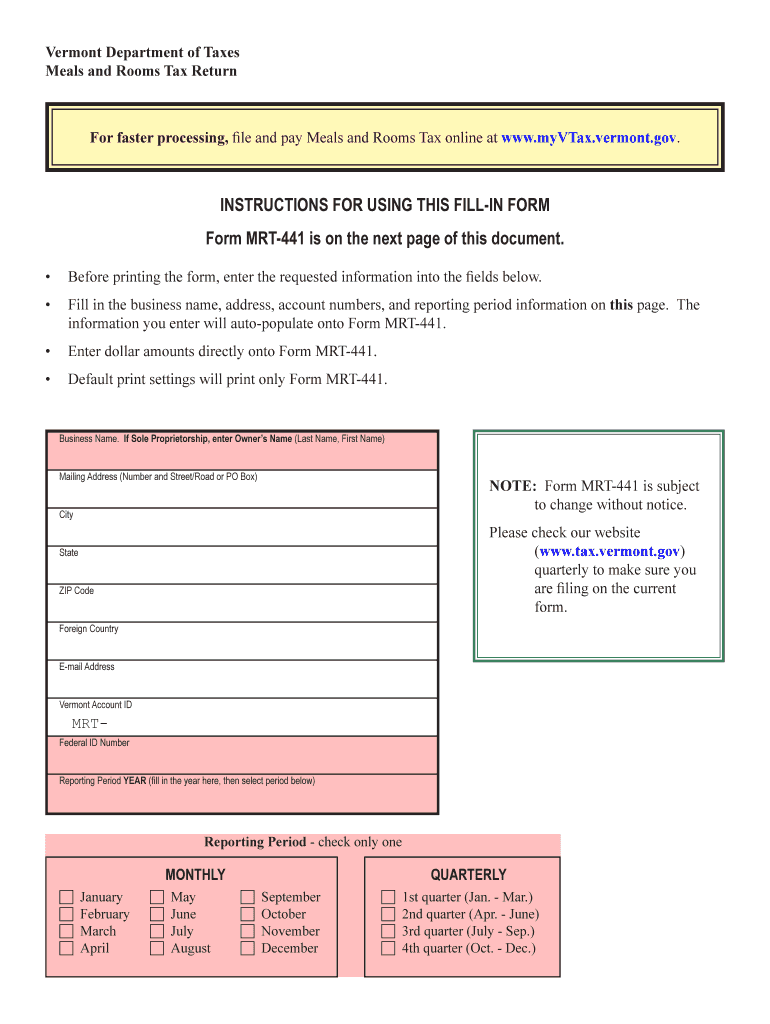

Mrt 441 Pdf Fill Out Sign Online Dochub

Alcohol Taxes On Beer Wine Spirits Federal State

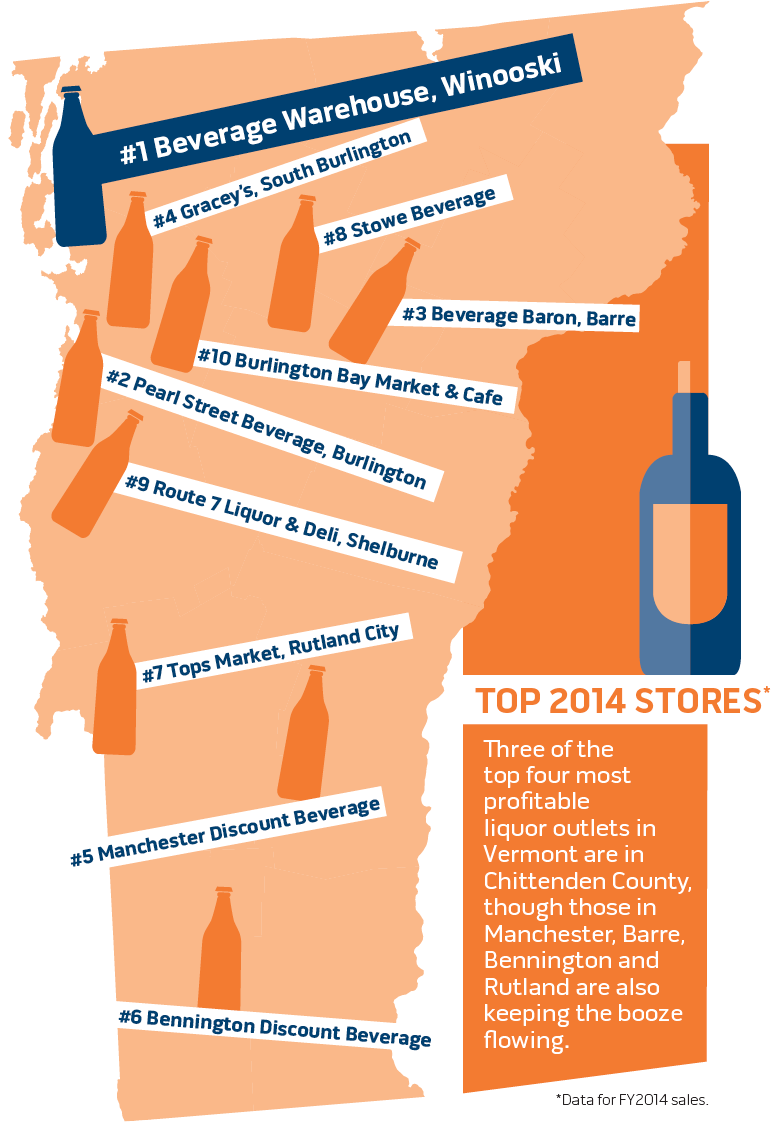

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Rising Liquor Sales Make The New Hampshire Vermont Border A Booze Battleground

Last Call Beer Institute Blasts Reduced Rtd Taxes In Vermont Ippolito Christon Warns Of Convenience Terminations Brewbound

Vermont Department Of Taxes Montpelier Vt

A Toast To Utah Liquor Dollars They Topped A Half Billion For First Time

Liquor Taxes State Distilled Spirits Excise Tax Rates Tax Foundation

Vermont Income Tax Vt State Tax Calculator Community Tax

Rising Liquor Sales Make The New Hampshire Vermont Border A Booze Battleground

Whistlepig 15 Year Old Straight Rye Whiskey Finished In Vermont Oak 750 Ml Bottle

Iowa S Spirits Excise Tax Is Among The Highest In The U S Distilled Opinion

General Sales Taxes And Gross Receipts Taxes Urban Institute

Beer Map How High Are Beer Taxes In Your State State Beer Map

New Vermont Law Lowers Tax On Ready To Drink Cocktails Expands Sales Vermont Thecentersquare Com